The Growth of Digital Wallets in Mobile App Development: What You Need to Know

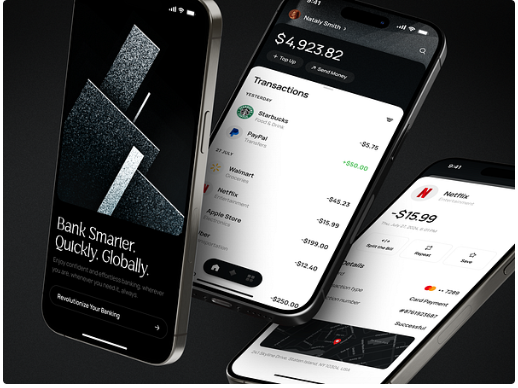

In the present quick-developing tech scene, digital wallets have arisen as perhaps the most groundbreaking development. With the shift towards credit-only exchanges and a developing inclination for mobile installments, the interest in secure, proficient, and easy-to-understand digital wallets is soaring. are going to top mobile app development companies in Chicago and past to use this development and assemble creative mobile wallet arrangements. Furthermore, the choice to hire mobile app developers in India is turning into a famous decision for companies hoping to make state-of-the-art digital wallet apps at a cutthroat expense.

This blog investigates the development of digital wallets in mobile app development, examines key patterns, and features why companies are selecting to hire developers from India to remain ahead in this serious market.

The Ascent of Digital Wallets

Digital wallets have changed how individuals oversee exchanges, from taking care of bills and shopping on the web to sending cash across borders. As additional customers embrace the accommodation of mobile wallets, companies are scrambling to integrate these elements into their apps. The developing ubiquity of digital wallets can be credited to a few variables, including the ascent of web-based business, the requirement for contactless installment arrangements, and the general shift toward a more digital economy.

Top mobile app development companies in Chicago are at the bleeding edge of this pattern, assisting companies with making secure, adaptable, and easy-to-use digital wallet arrangements. These companies are building mobile wallets without any preparation as well as coordinating wallet functionalities into existing apps to furnish clients with a consistent encounter.

Key Elements of a Digital Wallet App

While fostering a digital wallet, consolidating fundamental highlights is basic to guaranteeing both usefulness and client fulfillment. A few key elements include:

- Security: Clients request elevated degrees of safety for their monetary data. Digital wallet apps should incorporate high-level encryption, two-factor confirmation (2FA), and biometric checking.

- Usability: An easy-to-understand point of interaction is pivotal. The app ought to permit clients to perform exchanges effectively, track expenses, and oversee assets with insignificant contact.

- Multi-Cash Backing: With the rising globalization of web-based business, supporting numerous monetary standards is a significant addition for any digital wallet app. This element empowers clients to flawlessly execute in various monetary standards.

- Joining with Other Monetary Services: Numerous effective digital wallets incorporate with banking frameworks, unwaveringness projects, and even digital currency stages to give an exhaustive monetary biological system to clients.

- Contactless Installments: The ascent of NFC (Close Field Correspondence) technology has made it more straightforward for clients to make installments with simply a tap of their cell phone.

Why companies should zero in on digital wallets

As the digital installments scene keeps on developing, companies should adjust by offering clients the accommodation of mobile wallet arrangements. Here’s the reason digital wallets are fundamental for current companies:

- Accommodation: Clients favor fast, simple installment choices that don’t need actual money or cards. A digital wallet offers this comfort with only a couple of taps.

- Security: As network safety concerns develop, buyers are searching for installment strategies that shield their monetary data. Digital wallets use encryption and other security highlights to guarantee safe exchanges.

- Better Client Maintenance: Offering a digital wallet as a component of your app can essentially further develop client reliability. Highlights like prizes and cashback motivations urge clients to get back to the app and connect all the more as often as possible.

- Market Interest: The digital wallet market is developing quickly. By 2025, the worldwide market for mobile wallets is supposed to surpass $3 trillion, setting aside a rewarding room for companies to put resources into.

Why you ought to hire mobile app developers in India for your digital wallet app

Numerous companies are deciding to hire mobile app developers in India to fulfill the rising need for digital wallets. India is a center point for tech ability, offering excellent development services for a portion of the expense of hiring developers in Western nations. Here are a few key justifications for why this pattern is developing:

- Practical Arrangements: One of the essential reasons companies pick to hire developers from India is the huge expense reserve funds. The lower typical cost for most everyday items and cutthroat rates in India permit companies to get excellent apps created for a portion of the expense contrasted with neighborhood developers in the U.S. or then again Europe.

- Ability in mobile app development: Indian developers are profoundly gifted in building vigorous mobile apps, particularly in specialty regions like digital wallets. They are capable of the most recent developments, including blockchain, simulated intelligence, and AI, guaranteeing that your app is secure, adaptable, and imaginative.

- Time Region Benefit: The time region contrast among India and nations like the U.S. takes into account nonstop turns of events. This can altogether decrease development timetables, particularly while working with nimble strategies.

- Admittance to Worldwide Principles: developers in India stick to worldwide quality guidelines and are knowledgeable in working with worldwide clients. Whether you’re a private company or an undertaking, Indian developers can fit their answers to meet your particular necessities.

- Versatility: In the event that you’re working with a strict financial plan or need to scale rapidly, hiring developers in India gives you the adaptability to increase your group or down without the drawn-out responsibility that accompanies employing locally.

Digital wallet patterns to watch

As mobile wallets keep on filling in fame, certain patterns are reshaping the eventual fate of this technology. Top mobile app development companies in Chicago are effectively investigating these patterns to keep their clients on the ball:

- Reconciliation with Cryptographic Money: As digital monetary standards become more standard, companies are incorporating digital currency wallets into their apps, permitting clients to store and execute with digital currencies like Bitcoin and Ethereum.

- Computer-based intelligence and AI: Consolidating computer-based intelligence-driven highlights, for example, extortion identification and customized monetary exhortation, upgrades the client experience and adds a layer of safety to digital wallets.

- Voice-Enacted Installments: With the ascent of voice aides, digital wallets are starting to incorporate voice-initiated installment capacities, making it significantly more advantageous for clients to oversee exchanges in a hurry.

- Cross-Line Installments: Globalization has expanded the requirement for cross-line installment arrangements. Numerous digital wallets presently support global installments, offering a consistent encounter for clients going through with exchanges across nations.

Read more: How Much Does It Cost To Create A Smart Farm Weather App?

End

The digital wallet market is encountering unstable development, driven by progressions in technology, changing shopper inclinations, and the rising interest in consistent, secure, and easy-to-understand installment arrangements. By working with top mobile app development companies in Chicago and deciding to hire mobile app developers in India, companies can make creative digital wallet apps that address the issues of the present purchasers.

Whether you’re wanting to coordinate a wallet highlight into your current app or construct an independent digital wallet, the right development group can assist you with remaining in front of the opposition in this quickly developing business sector.